Amazon is the go to place for most people when it comes to buying non-prescription hair loss products. On this page, I list some of the most popular products based on number of Amazon reviews.

November 28, 2025

Black Friday and Cyber Monday Sales

This year’s Black Friday and Cyber Monday offer some great deals:

- The HairMax laserband is on sale for 41% off and also has an additional 15% brand promotion coupon code that you have to redeem. Around 55% off in total.

- Nioxin System 2 hair thickening shampoo is discounted by 50%.

- The unique Nioxin shampoo with caffeine and sandalore is on sale at 48% off.

- The highly rated Toppik hair loss concealer is priced at a 40% discount.

- The new FDA cleared PUPCA laser cap is currently on sale at just around $160 after a discount and an additional brand promotion application. This is much cheaper than other laser caps on the market.

May 17, 2025

Hair Vitamins

Hair vitamins are an especially popular product on Amazon. Partly because of their relatively low cost.

Do note that in most cases, vitamins, herbs and natural products will not lead to any kind of hair regrowth. Unless you are severely deficient in any specific vitamin or mineral.

- Nature’s Bounty Biotin has 110,000 reviews, with an average rating of 4.7 out of 5 stars. The rapid release softgels claims to benefit hair, nails and skin.

- Vitafusion multivitamin gummies has 90,000 reviews, with an average rating of 4.6 out of 5 stars. It includes Vitamin B, Biotin, Vitamin D and Retinol among other ingredients. It claims to benefit hair, nails and skin.

- Sugarbear Hair Vitamins has 50,500 reviews, with an average rating of 4.2 out of 5 stars. They are in gummy form and vegan. They include Vitamin A, Biotin, Vitamin C, Choline, Vitamin D, Vitamin E, Vitamin B-6, Vitamin B-12, Folate, Iodine and Zinc.

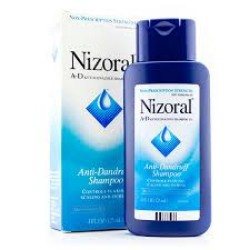

Shampoos

Not surprisingly, some of the best hair loss shampoos and anti-dandruff shampoos also have a massive number of reviews.

- Nizoral anti-dandruff shampoo has 106,000 reviews, with an average rating of 4.6 out of 5 stars. It also has anti-androgenic effects.

- Tea Tree Special shampoo has 60,900 reviews, with an average rating of 4.6 out of 5 stars.

- Pura D’Or has become a renowned brand name in the world of hair. Its anti-thinning biotin shampoo and conditioner set currently has 32,000 reviews, with an average rating of 4.3 out of 5 stars.

- The evergreen Head & Shoulders Classic has 21,500 reviews, with an impressive average rating of 4.8 out of 5 stars.

- I covered Nioxin in the past. Its System 2 currently has 21,500 reviews, with an average rating of 4.6 out of 5 stars.

Concealers

I have not updated my best hair loss concealers post for a while. But the usual suspects still remain bestsellers.

- Toppik has 70,000 reviews, with an average rating of 4.3 out of 5 stars. I had great results from using this concealer in the past.

- Boldify has 30,400 reviews, with an average rating of 4.3 out of 5 stars.

Other Hair Loss Products

Below I list other very popular hair loss products on Amazon. Feel free to add comments if you find others with more customer reviews.

I covered both Viviscal and Nutrafol in the past. They are among the most popular supplements on Amazon that are specifically developed for hair loss.

- Viviscal currently has 30,000 reviews, with an average rating of 4.3 out of 5 stars.

- Nutrafol has 18,000 reviews, with an average rating of 4.2 out of 5 stars.

- Men’s Rogaine foam has 27,900 reviews and a 3-month supply is currently being sold at a big discount of 25%. It has an average rating of 4.2 out of 5 stars. Interestingly, Women’s Rogaine has 18,600 reviews, a somewhat higher number than I would expect relative to the men’s product.

Also make sure to check out all the products listed in my post on Redensyl, Capixyl, Procapil and Baicapil.